What is DINERO?

The native cryptographically-secure fungible protocol token of the Dinero Protocol (ticker symbol DINERO) is a transferable representation of attributed governance and utility functions specified in the protocol/code of Dinero. It is designed to be used solely as an interoperable utility token within the Dinero ecosystem.

DINERO is a functional multi-utility token used as the native governance token and for economic incentives. These incentives are distributed to encourage users to contribute and participate in the ecosystem, thereby creating a mutually beneficial system where every participant is fairly compensated for their efforts.

DINERO is integral and indispensable to the Dinero Protocol. Without DINERO, there would be no incentive for users to expend resources to participate in activities or provide services for the benefit of the entire ecosystem. Additional DINERO will be awarded to a user based on actual usage, activity, and efforts made on Dinero, or proportionate to the frequency and volume of transactions. Users of Dinero and/or holders of DINERO who do not actively participate will not receive any DINERO incentives.

DINERO does not represent any shareholding, ownership, participation, right, title, or interest in the Company, the Distributor, their respective affiliates, or any other company, enterprise, or undertaking. DINERO will not entitle token holders to any promise of fees, dividends, revenue, profits, or investment returns, and is not intended to constitute securities in the British Virgin Islands, Singapore, or any relevant jurisdiction.

DINERO may only be utilized on the Dinero Protocol. Ownership of DINERO carries no rights, express or implied, other than the right to use DINERO as a means to enable usage of and interaction within Dinero. The secondary market pricing of DINERO is not dependent on the effort of the Dinero team, and there is no token functionality or scheme designed to control or manipulate such secondary pricing.

How to get DINERO?

Users can acquire DINERO on Uniswap or through a router like 1inch or Cowswap. Additionally, you can earn DINERO rewards by participating in pxETH/apxETH DeFi farming opportunities, which you can find here.

What is DINERO's max supply?

DINERO’s max token supply is 1.3 billion. You can find details on the circulating supply using Coingecko.

What is DINERO's emission schedule?

DINERO’s supply of 1.3 billion tokens is distributed over a 10-year period.

What is DINERO staking?

DINERO staking allows users to deposit their DINERO tokens into a staking contract to gain greater governance power and earn additional DINERO rewards. Each staked DINERO token is worth three votes in governance, compared to one vote for an unstaked token.

The staking process includes a warm-up period before tokens become fully active and a cooldown period before tokens can be unstaked. This ensures stability and guards against governance attacks within the ecosystem.

Where do DINERO staking rewards come from?

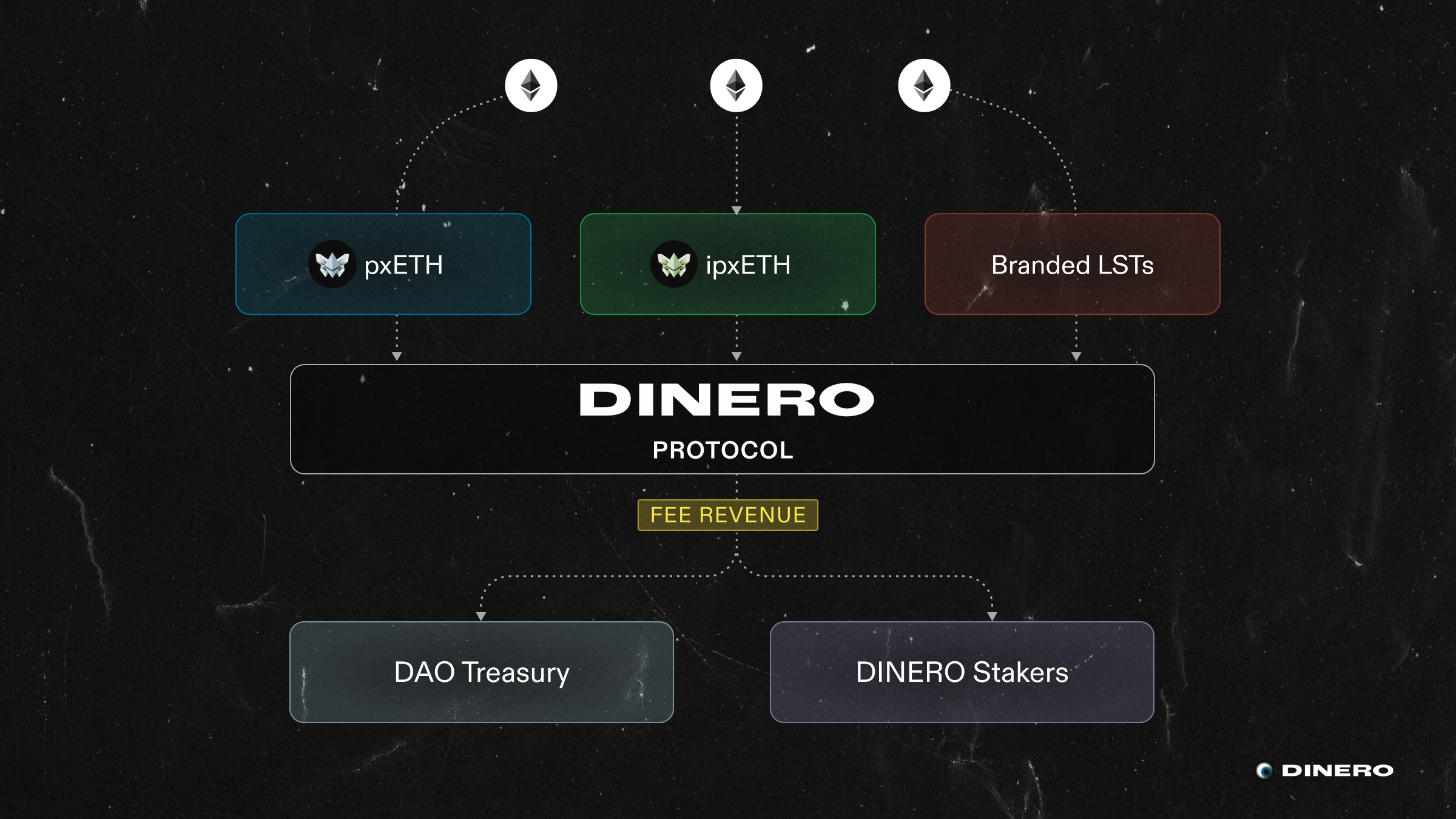

DINERO rewards come from pulse token supply and fees taken by the Dinero product suite (example illustrated above). Below is a more detailed breakdown of all products under the Dinero umbrella:

DINERO rewards come from pulse token supply and fees taken by the Dinero product suite (example illustrated above). Below is a more detailed breakdown of all products under the Dinero umbrella:

- Hidden Hand fees:

- 50%: DINERO staking pool

- 35%: Treasury

- 15%: DAO Reserves

- Pirex fees (pxCVX, pxGMX):

- 42.5%: DINERO staking pool

- 42.5%: Treasury

- 15%: DAO Reserves

- Dinero Protocol (pxETH) net fees:

- 42.5%: DINERO staking pool

- 42.5%: Treasury

- 15%: DAO Reserves

All fees distributed to the DINERO staking pool are distributed as DINERO.

What is the “Incentives” token supply?

The pulse token supply represents DINERO allocated for strategic treasury initiatives. These initiatives include incentivizing current and future Dinero products, funding liquidity pools, building our non-DINERO treasury through mechanisms such as bonds, DAO swaps, and other protocol-controlled value (PCV) building mechanisms, and participating in seed rounds.

The “Incentives” token supply is critical for helping the protocol grow over the next few years, from a treasury, product, and user adoption perspective. DINERO distributions allocated to the “Incentives” token supply are not used immediately but will be utilized as efficiently and effectively as possible. They are intended to incentivize adoption and grow the protocol until Dinero becomes fully funded by protocol yield.

What are the DAO reserves?

DAO Reserves are funded by 15% of the DINERO supply and 15% of protocol yield. These funds cover all operational costs of the DAO, including team compensation, audits and bug bounties, marketing materials and conferences, and any other operational expenses. This also includes DAO-to-DAO swaps, treasury raises, and derisking strategies to ensure that the DAO reserves have sufficient funds to continue operating the protocol after DAO reserves emissions end.