Summary

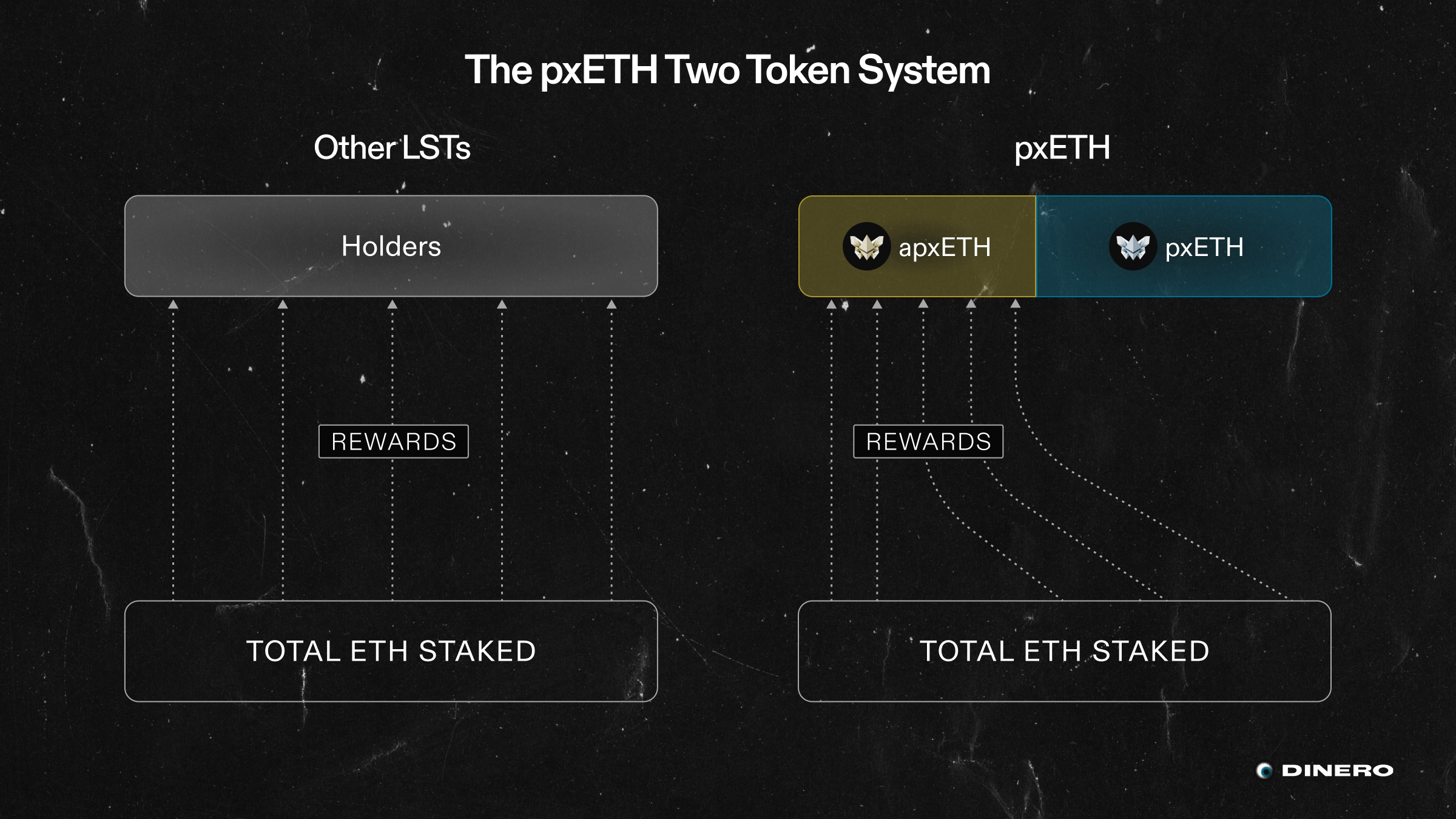

pxETH is an Ethereum liquid restaking solution that forms the foundation of the Dinero protocol. It uses a two-token system: pxETH and apxETH. This design provides users with a choice between liquidity and DeFi yields or boosted ETH staking yield and restaking yield.

pxETH and apxETH

When depositing ETH, users can choose to hold pxETH or deposit it into an auto-compounding rewards vault for apxETH (i.e. staking their ETH).

When depositing ETH, users can choose to hold pxETH or deposit it into an auto-compounding rewards vault for apxETH (i.e. staking their ETH).

pxETH is for those prioritizing liquidity over staking yield. Holding pxETH means holding an ETH-pegged asset that can be used across DeFi for providing liquidity, participating in lending protocols, and more. Dinero's treasury and DINERO incentives will support and expand these opportunities for pxETH holders.

apxETH is for users focused on maximizing staking yields. After minting pxETH, users can deposit it into Dinero's auto-compounding rewards vault to enjoy boosted staking yields without managing their own validators. Since some users will hold pxETH, each apxETH benefits from the staking rewards of more than one staked ETH, amplifying yields for apxETH holders.

Restaking Yield

EigenCloud restaking is built directly into pxETH's protocol architecture. apxETH holders automatically receive both staking and restaking yield without any additional steps or complexity.

Deposits and the ETH Buffer

Most ETH deposited into the Dinero protocol via pxETH is staked on the Ethereum network. However, a small fraction remains in an 'ETH buffer' instead of being staked. This buffer facilitates smooth staking and unstaking, allows faster ETH withdrawals when funded, and will support self-contained meta transactions through the permissionless RPC in the future.

Withdrawals

Validator entry and exit rates on the Ethereum network are limited by the total number of validators. Consequently, a significant ETH unstaking queue can delay ETH withdrawals from the Dinero protocol due to the spinning down of validators. To address this, an incentivized withdrawal pool can be used to improve pxETH liquidity from ETH unstaking.

Users can deposit ETH into this pool and earn rewards while providing liquidity. If there is an unstaking queue and ETH from validators is not readily available, ETH from this pool is provided to users in exchange for pxETH. The exchange rate is determined by the demand for ETH from the pool. As pxETH is redeemed and validators are spun down, ETH is replenished in the pool. Depositors into the withdrawal pool thus receive rewards for potential ETH illiquidity.

Pricing depends on ETH demand in the pool, with rewards on deposited ETH increasing during periods of high demand, allowing the pool to scale efficiently and cost-effectively.

- 1 pxETH principal semi-fungible token which can be exchanged for 1 pxETH in one year; and

- 1 pxETH yield semi-fungible token for each rewards period in the next year, which can be exchanged for the rewards earned by 1 pxETH in the rewards vault in one rewards period.

Users decide how many reward cycles they tokenize. These tokens can be used throughout DeFi and are tradable. Yield stripping provides users the ability to leverage, hedge, and speculate on future pxETH price and future yield.