Pirex SOL

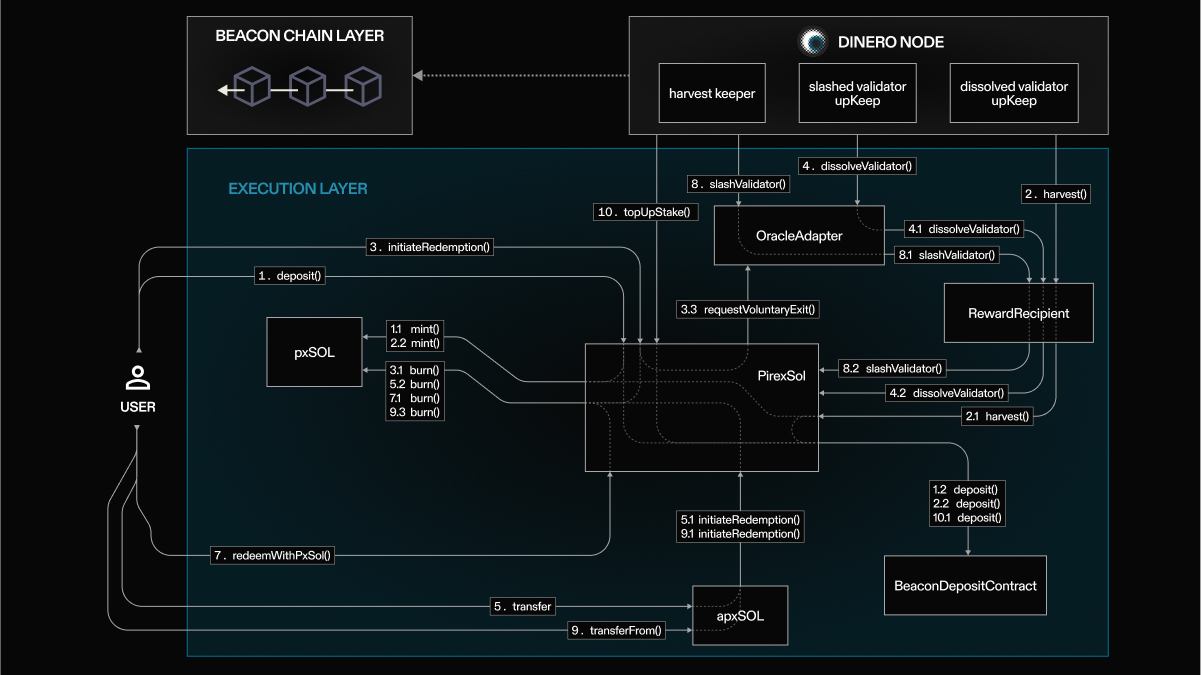

SOL is deposited into the Dinero protocol on-chain via Pirex SOL smart contracts. pxSOL, a liquid staking token, is minted 1:1 for deposited SOL. The majority of the SOL is staked through Galaxy validator infrastructure and used to validate transactions on the Solana network. The remainder is kept unstaked and is referred to as the "SOL buffer".

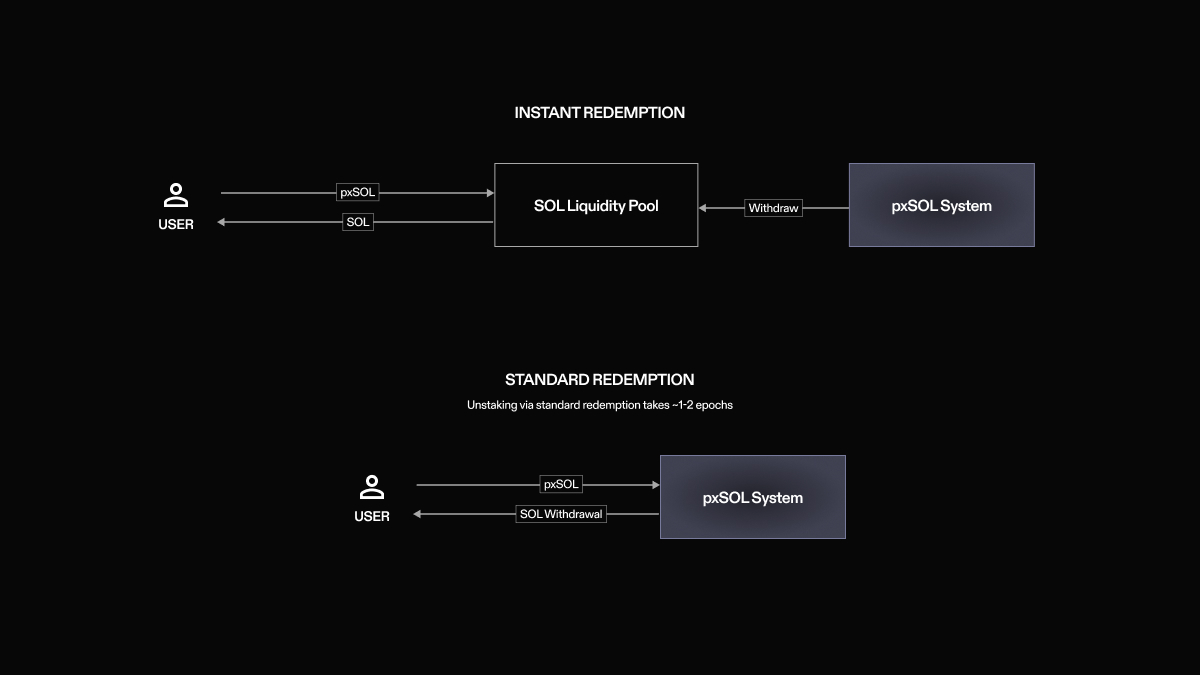

SOL can be withdrawn from the Dinero protocol in exchange for pxSOL. This SOL either comes from the pxSOL buffer (if there is SOL available) or from the unstaking of SOL through the Solana validator network. In cases where the withdrawal requires unstaking from validators, users will need to wait for the Solana unstaking period to complete, which varies based on epoch timing and network capacity.

A withdrawal fee is levied on withdrawals: 0.1% for instant redemptions through the SOL buffer and 0.05% for normal withdrawals that require unstaking. These withdrawal mechanisms allow for SOL:pxSOL peg maintenance and provide liquidity options for users.

Solana Unstaking Mechanics

Solana's unstaking process differs from Ethereum's validator system. Unstaking on Solana depends on epoch timing and network capacity, with unstaking periods typically ranging from 1-2 days. The protocol tracks pending withdrawals in state rather than issuing separate utility tokens, simplifying the user experience while maintaining accurate accounting of owed SOL.

SOL Buffer

A small percentage of the SOL deposited into the Dinero protocol is kept unstaked. This helps facilitate smooth staking and unstaking operations while allowing for immediate SOL withdrawals when the buffer is funded. The buffer size is algorithmically managed based on protocol usage patterns and withdrawal demand.